Home loan calculators to help you work out your financial position This can be done via a redraw facility, if your loan comes with that feature. Also consider whether your loan gives you the option of being able to withdraw any extra repayments you have made if you end up needing that money in the future. It’s a good idea to check what’s allowed on your particular home loan before you commit to making extra repayments.

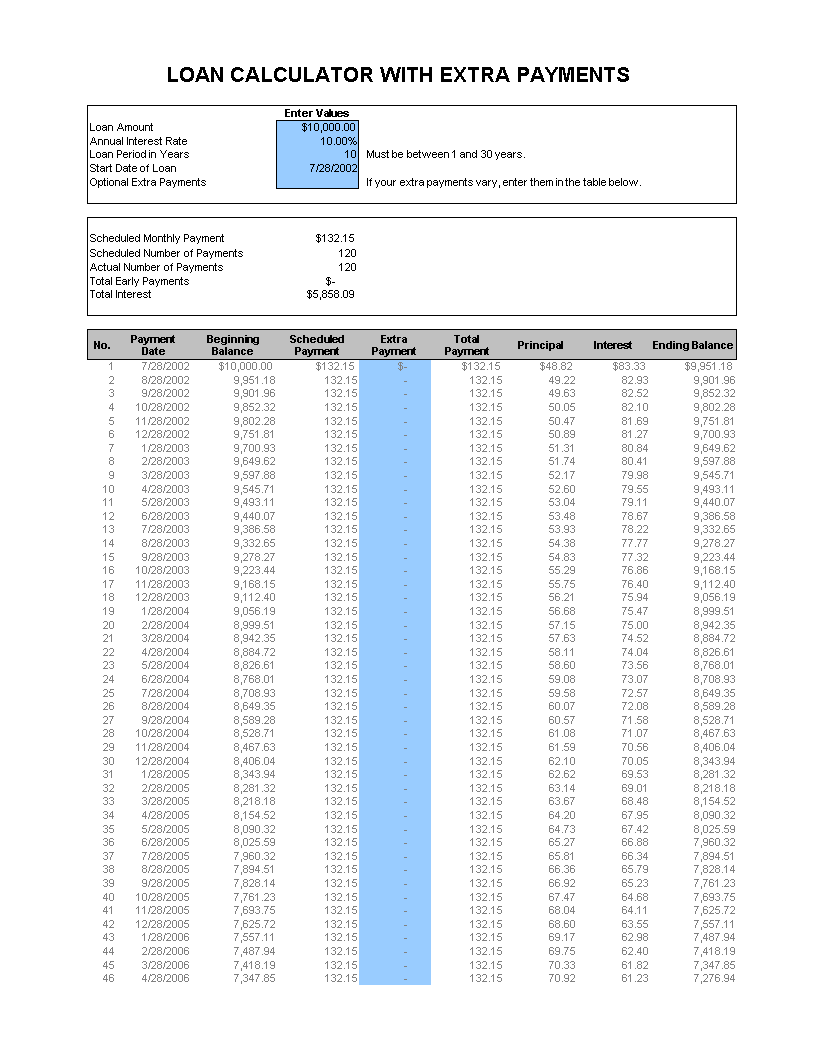

when you get your tax return).Ĭanstar’s home loan extra repayments calculator allows you to “try out” many different calculations about additional repayments you could make on a home loan.īear in mind, extra repayments are not allowed, or can be limited, on some loans (this can be the case with some fixed rate loans), or there may be penalties if you make payments beyond the minimum in your contract. Depending on the loan, you may be able to increase your regular repayment so you’re simply paying off a bit extra each month, fortnight or week, or you may also be able to make one-off extra lump sum repayments, in the event that you have some extra cash at a particular time (e.g. Use Canstar’s home loan selector to view a wider range of home loan products.Įxtra repayments on a mortgage are any payments you make on top of the minimum regular repayment amount that is listed on your home loan contract. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether extra repayments are permitted under the terms of the loan, whether any additional fees or charges may apply and whether the terms of the loan meet your needs and repayment capacity.*Comparison rate based on loan amount of $150,000 and a term of 25 years. Choose between the First Home, Next Home, Investing and Refinance tabs to view results most relevant to you. Products shown are principal and interest home loans available for a loan amount of $500K in NSW with an LVR of 80% of the property value and where the borrower is allow to make additional repayments. If you’re in the market for a new home loan, the comparison table below features a snapshot of some of the outstanding value variable rate home loans on our database with links to lenders’ websites, sorted by comparison rate (lowest-highest) and then alphabetically by provider name. 5-Star Rated Home Loans on Canstar’s database

0 kommentar(er)

0 kommentar(er)